Investment Opportunity Review for 8156398343, 91893788, 2045387715, 7206431890, 3013888, 640169363

The investment opportunity review for portfolios 8156398343, 91893788, 2045387715, 7206431890, 3013888, and 640169363 requires a careful examination of each option’s potential returns and associated risks. Analyzing market trends is essential for aligning these investments with individual financial objectives. Moreover, understanding the strategies that can optimize portfolio performance is crucial. As the financial landscape evolves, what factors will prove most influential in shaping successful investment choices?

Overview of Investment Options

When evaluating potential investment opportunities, it is essential to understand the various options available in the market.

Investors often consider real estate and the stock market as primary choices. Real estate offers tangible assets with potential for appreciation, while the stock market provides liquidity and diversification.

Each option presents unique characteristics that require thorough analysis to align with individual financial goals and risk tolerance.

Potential Returns and Risks

Understanding the potential returns and risks associated with different investment opportunities is crucial for informed decision-making.

Analyzing historical performance provides insights into possible future gains, while thorough risk assessment helps identify vulnerabilities within each investment option.

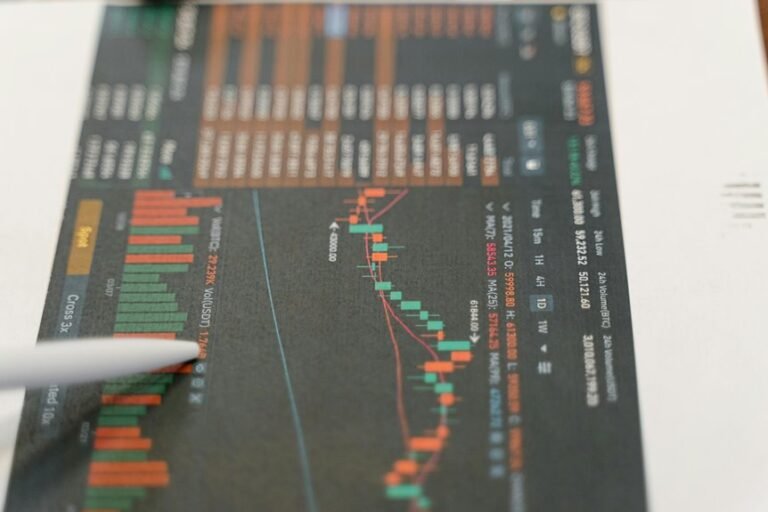

Market Trends and Analysis

As global economies continue to evolve, recognizing prevailing market trends becomes essential for investors seeking to optimize their portfolios.

Recent market fluctuations highlight the importance of monitoring economic indicators, such as GDP growth, unemployment rates, and inflation.

Understanding these factors enables investors to make informed decisions, adapting strategies to capitalize on opportunities while mitigating risks inherent in an unpredictable financial landscape.

Strategies for Investors

While various market conditions can influence investment outcomes, employing well-defined strategies remains crucial for investors aiming to enhance their financial performance.

Diversification benefits can mitigate risk, allowing investors to spread their capital across various asset classes.

A strategic asset allocation tailored to individual risk tolerance and investment goals enables a balanced portfolio, optimizing returns while safeguarding against market volatility.

Conclusion

In conclusion, a meticulous assessment of the investment portfolios—8156398343, 91893788, 2045387715, 7206431890, 3013888, and 640169363—reveals varying potential returns and associated risks. For instance, Portfolio 2045387715, heavily weighted in tech stocks, may yield higher returns but carries significant volatility. By aligning investment strategies with personal risk tolerance and market trends, investors can make informed decisions that enhance their financial outcomes, ultimately fostering a resilient and adaptive investment approach.