Investment Benchmark Indicators on 934139206, 3780800, 965272863, 211501815, 958405577, 911087146

Investment benchmark indicators associated with the unique identifiers 934139206, 3780800, 965272863, 211501815, 958405577, and 911087146 play a crucial role in assessing portfolio performance. These indicators reveal market volatility and investment risk, offering critical insights for investors. Analyzing these benchmarks enables a thorough understanding of market alignment. However, the implications of these evaluations extend beyond mere performance metrics, prompting further exploration into strategic decision-making processes.

Understanding Investment Benchmark Indicators

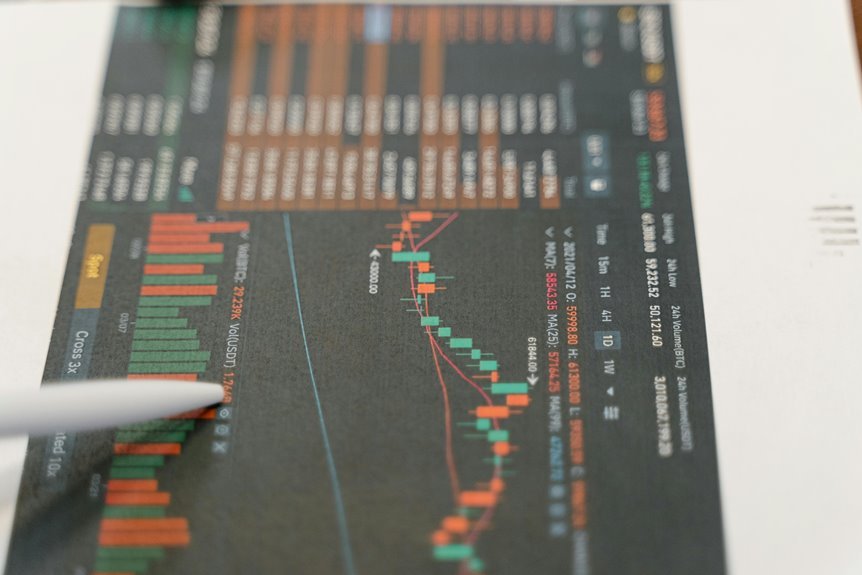

Although investment benchmark indicators serve as essential tools for measuring performance, their significance extends beyond mere numerical comparisons.

They provide insights into investment risk and market volatility, enabling investors to assess how well their portfolios align with broader market trends.

Understanding these indicators allows for informed decision-making, fostering a sense of autonomy in navigating the complexities of investment landscapes while minimizing exposure to unforeseen financial fluctuations.

Detailed Analysis of Unique Identifiers

As investors seek to evaluate the effectiveness of their portfolios, understanding unique identifiers becomes crucial for establishing a clear framework for performance assessment.

Unique identifier analysis allows for precise tracking of individual investments, facilitating performance comparison across varied benchmarks.

This analytical approach enables a deeper insight into portfolio dynamics, ultimately empowering investors to make informed decisions and optimize their investment strategies.

Evaluating Performance Metrics

When assessing the performance of an investment portfolio, the selection of appropriate metrics is essential for drawing meaningful conclusions.

Effective performance evaluation requires a thorough metrics comparison, enabling investors to identify strengths and weaknesses within their strategies.

Strategic Insights for Investors

The evaluation of performance metrics lays the groundwork for developing strategic insights that can enhance investment decision-making.

By analyzing market trends and conducting thorough risk assessments, investors can identify potential opportunities and pitfalls.

This analytical approach fosters informed strategies, empowering investors to navigate the complexities of the financial landscape with freedom and confidence, ultimately promoting more effective portfolio management and investment outcomes.

Conclusion

In conclusion, the analysis of investment benchmark indicators associated with unique identifiers 934139206, 3780800, 965272863, 211501815, 958405577, and 911087146 reveals critical insights into market dynamics and portfolio performance. By utilizing these benchmarks, investors can enhance their strategies and mitigate risks effectively. As they navigate complex market environments, one must ponder: how can a thorough understanding of these indicators transform investment decisions and outcomes? Such reflections are essential for optimizing financial success.